Net assets, financial position and results of earnings

- Operating result at record levels

- Equity exceeds EUR 5 billion for the first time

- Significant increase in cash flow

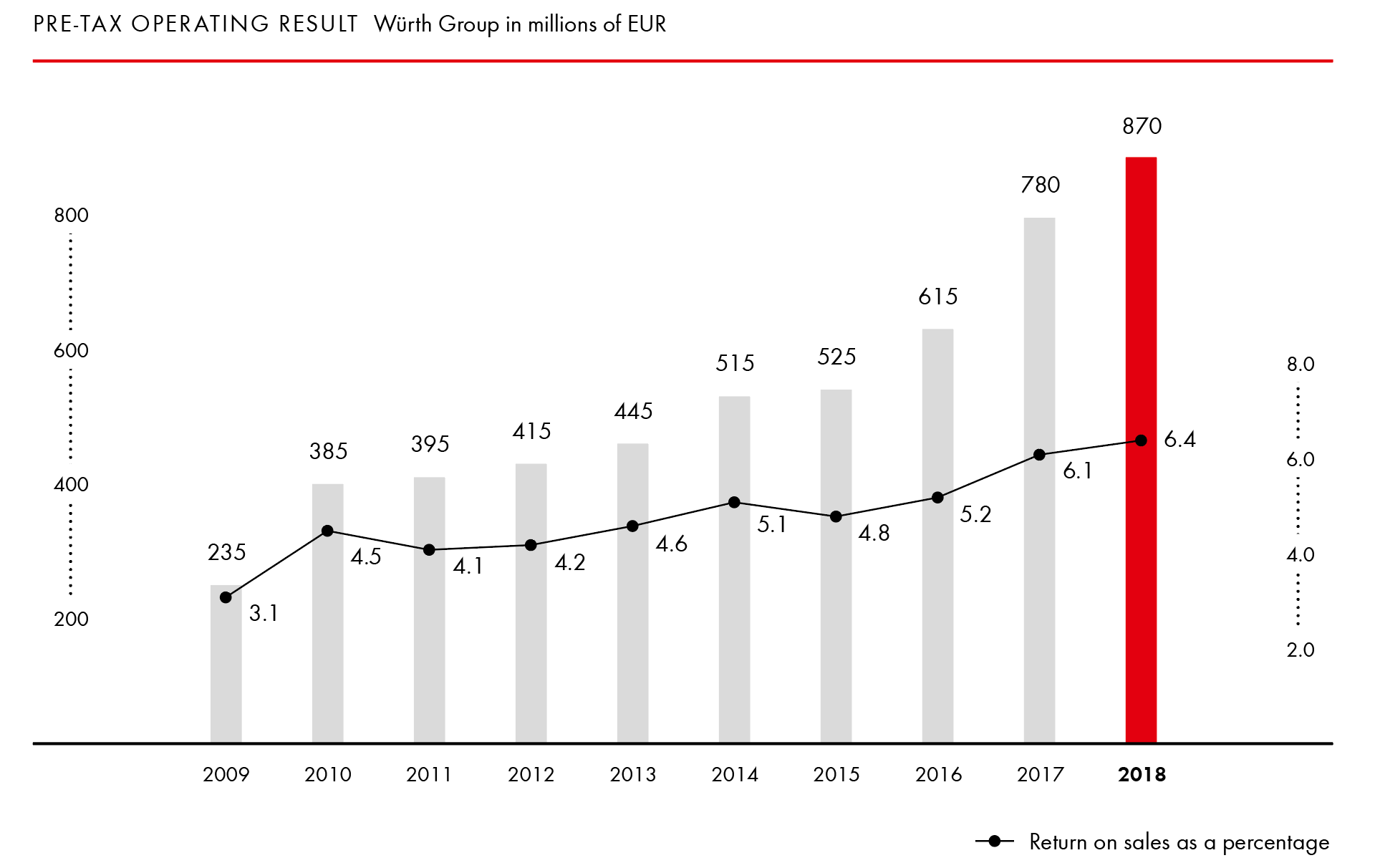

At EUR 870 million, the Würth Group once more achieved a record operating result. Compared to the previous year, that amounts to a rise of 11.5 percent. As a result, the return increased to 6.4 percent (2017: 6.1 percent). We have calculated the operating result as earnings before taxes, before amortization of goodwill and financial assets, before the collection of negative differences recognized in profit or loss, before the adjustment of purchase price liabilities from acquisitions through profit or loss, and before changes recognized in profit or loss from non-controlling interests disclosed as liabilities.

After an above-average increase of 19.9 percent in the 2017 operating result in Germany, the 2018 result was EUR 436 million (2017: EUR 421 million), which corresponds to an increase of 3.6 percent. The only moderate increase in earnings was due in part to the restructuring of companies in the Chemicals unit. The German companies accounted for 50.1 percent of the Group’s total earnings, with a return on sales of 7.5 percent (2017: 7.8 percent). With a new record of over EUR 160 million, Adolf Würth GmbH & Co KG made by far the largest contribution to earnings. Other top performers within Germany included: Würth Elektronik eiSos, Würth Industrie Service, Arnold Umformtechnik and Reca Norm.

The companies outside of Germany boosted their operating result by 20.9 percent to EUR 434 million (2017: EUR 359 million). As a result, the earnings growth of these companies was significantly more dynamic than that of the domestic group. This momentum is due, first of all, to improved earnings at established direct selling and distribution companies such as Würth Italy. On the other hand, the restructuring of the direct selling business towards multichannel sales in China and Switzerland was successfully continued. By contrast, the situation in Great Britain is difficult due to the uncertainties surrounding Brexit. At present, however, we do not see any significant effects of Brexit on the net assets, financial position and results of earnings for the Würth Group. The need for restructuring at individual industrial companies in the US and Scandinavia also prevented even stronger earnings growth.

At 49.9 percent, the cost of materials ratio was slightly above the previous year’s level (2017: 49.1 percent). Increased raw material prices prevented the cost of materials ratio from remaining constant. At EUR 96 million, other operating income was down significantly on the previous year (2017: EUR 132 million). The decline resulted from a special effect in 2017, in which other operating income increased by EUR 31.9 million due to the revaluation of earn-out liabilities in the US industrial companies.

At the end of December 2018, the Würth Group had a total of 77,080 employees. The increase in the workforce by 2,921 compared with December 2017 was one of the reasons behind the sales growth that the company achieved, as face-to-face contact is the strength of our direct selling approach. The sales force works hand in hand with our highly effective in-house staff, who provide the necessary support for the specific sales strategy. The sales team was increased by 923 employees in 2018. The increase in in-house staff amounted to 4.8 percent. Adjusted for acquisitions, the increase was 4.2 percent. At 26.8 percent, the ratio of personnel expenses to sales improved compared with the previous year (2017: 27.3 percent). One major reason was the increase in productivity.

At EUR 375 million, amortization and depreciation was down considerably on the prior year in 2018 (2017: EUR 426 million). In 2017, depreciation increased due to the increase in impairment losses on goodwill at the US industrial companies. This fact ceased to apply in 2018 and is therefore a major reason for the decrease in depreciation in 2018. Amortization and depreciation, resulting from the investments made on the one hand, and from the acquisitions realized on the other hand, rose compared with the previous year’s level.

Other operating expenses showed a below-average increase in relation to sales growth in the year-on-year comparison. The ratio was down on the previous year at 14.7 percent (2017: 15.2 percent). In the areas of maintenance and repair as well as freight and delivery costs, the corresponding expenses increased at a disproportionately low rate and thus contributed to an improvement in the ratio. The rental and lease segment developed in line with sales growth.

Net financing expenses decreased. This development was mainly due to exchange rate gains resulting from currency translation.

The tax rate decreased in the 2018 fiscal year to 20.5 percent (2017: 24.8 percent). A major reason for this development is the decrease in non-deductible amortization of goodwill, primarily in connection with the increased impairment losses in the US industrial companies in 2017. In addition, a tax refund in the USA in 2018 had a tax-reducing effect. For a detailed analysis, please refer to the consolidated financial statements: G. “Notes on the consolidated income statement”, [9] “Income taxes.”

In the last fiscal year, the Würth Group reported sales of EUR 13.6 billion and an operating result of EUR 870 million, allowing it to set two new records and achieve its objectives. Net income for the year rose to EUR 687 million. Against the backdrop of the global economic developments, the Central Managing Board believes that these results are highly satisfactory. The main KPIs, such as sales and operating result, have significantly improved. Our gross profit, i.e. sales minus the cost of goods sold, along with our staff turnover, stock turnover and revenue productivity, also improved or are at an acceptable level.

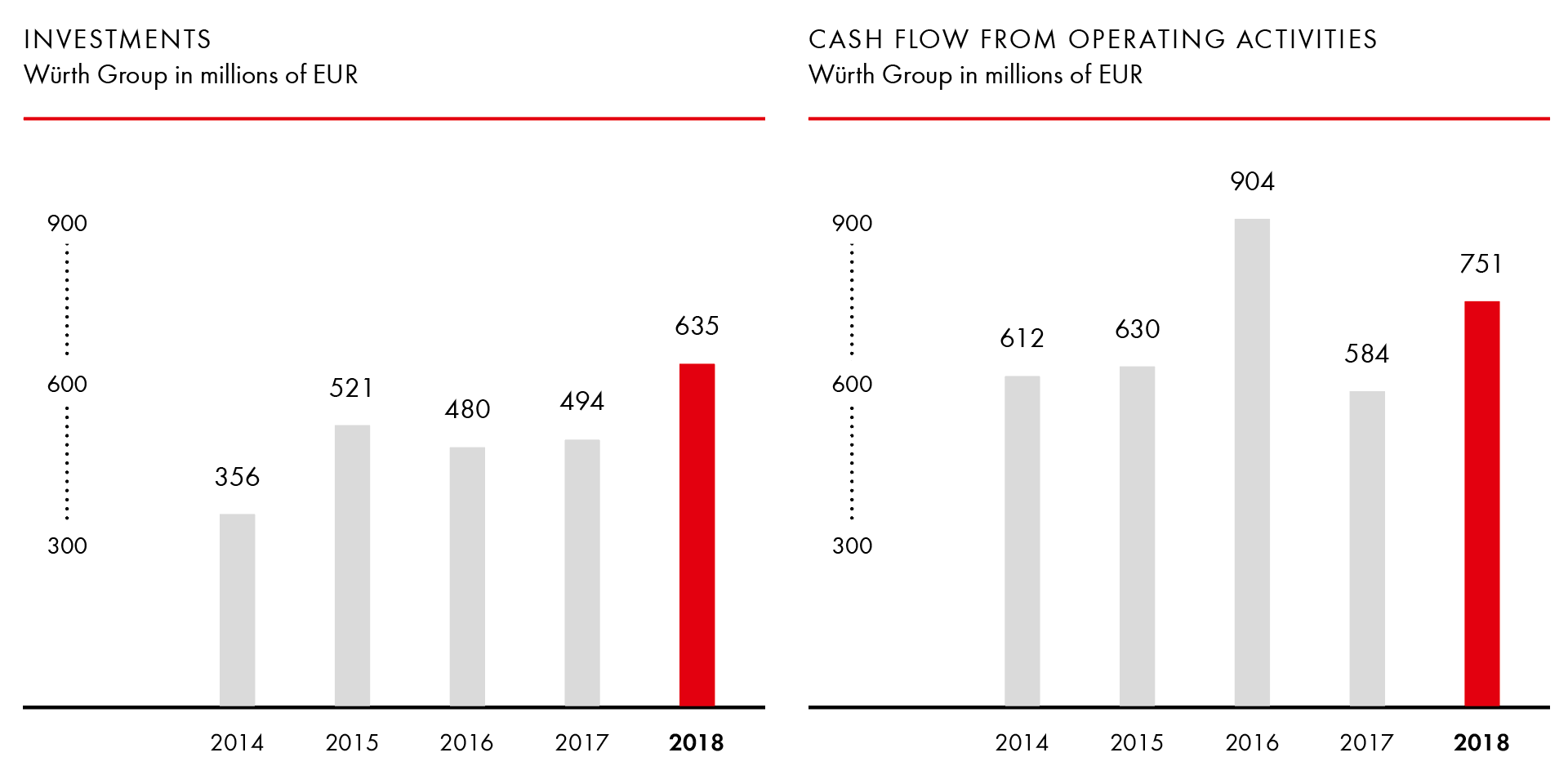

Capital expenditures and cash flow

Growth is inextricably linked to the self-image of the Würth Group. Growth by tapping into new markets and growth in existing markets require optimal underlying conditions. One of the ways in which the Würth Group achieves such conditions is through sustainable investment. Over the past ten years, the Group has invested around EUR 4.3 billion. It has always been the Würth Group’s strategy to invest in sales-related and productive areas. Of the investments made over the past fiscal year totaling EUR 635 million (2017: EUR 494 million), a focus was placed on the expansion of IT infrastructure and warehouse capacities for our distribution companies, as well as on production buildings and technical equipment and machinery for our manufacturing companies.

Kellner & Kunz AG from Wels, Austria, is an expert in screws, tools, and DIN and standard parts. During the period from 2018 to 2020, the company will be investing around EUR 45 million in a further expansion stage in the logistics area. The enlarged warehouse in Wels not only supplies all customers from trade and industry in Austria, Eastern and Southeastern Europe, but also makes it possible for all deliveries to industrial customers of the RECA Group division in Europe to be made from the central warehouse in Wels. The switch to a “goods-to-man” system and parallel order picking will speed up order processing, which will be reflected in even greater customer satisfaction.

Expansion became necessary only two years after the opening of the ultra-modern logistics center due to the rapid growth of the Würth Elektronik eiSos Group. With the construction of 4,000 m² logistics floor space and a fully automatic shuttle warehouse on 1,300 m² floor space, the existing warehouse, picking and logistics areas at the Waldenburg location will be doubled once again. The new shuttle warehouse alone comprises 36,000 m³ of converted space. With the new building, Würth Elektronik eiSos underscores its high service standards, which ensure the fast delivery of samples and large quantities of electronic and electromechanical components to customers all over the world. The investment volume comprises an additional EUR 25 million.

In addition to the companies comprising the Allied Companies, Würth Line companies also invested heavily in the expansion of their sales activities—above all Adolf Würth GmbH & Co. KG should be mentioned in this context. In June 2018, the groundbreaking ceremony for the largest logistics investment to date in the Würth Group took place with an investment volume of around EUR 73 million. The new transshipment warehouse for Adolf Würth GmbH & Co KG is pursuing an optimized logistics strategy that avoids delivery splits and bundles items per order so that the customer receives exactly one parcel or shipment. On an area of 50,000 square meters, 62 docking stations for loading and unloading trucks are being built. In addition to a total of 12,800 pallet spaces, new capacities will also be created for large-volume and bulky items. In the final phase, around 300 employees will work in two shifts in the new logistics complex. Completion is planned for summer 2020.

Würth Industrie Service invested EUR 43 million in Bad Mergentheim in 2018 in order to continue offering customers maximum security of supply and the highest product, service and system quality. Among other things, work began on the expansion of the OSR shuttle warehouse and the high-bay warehouse to include an additional 39,000 storage spaces. Further investments in buildings, technologies such as open shuttles as driverless transport systems, picking and palletizing robots, and storage capacities are planned, so that an increase to more than 1,000,000 storage spaces can be expected by 2020.

In total, EUR 362 million, or 57.0 percent of the investment volume, was attributable to Germany, reflecting the continued paramount significance of the home market for the Würth Group.

Thanks to our efficient investment controlling processes using sophisticated recording and analysis tools, the Central Managing Board is always in a position to react quickly to changes in the overall environment. This is another reason why we once again met our objective of financing investments in intangible assets and in property, plant and equipment from our cash flow from operating activities in full in 2018. This amount was EUR 751 million (2017: EUR 584 million) and thus 28.6 percent higher than the previous year. The reasons for the increase were primarily the lower build-up of inventories to secure the ability of the Würth Group to deliver as well as the lower increase in trade receivables compared to 2017. The increase in liabilities from financial services is also reflected positively in cash flow. The financing of the investments of EUR 635 million in 2018 required 84.6 percent of the operating cash flow (2017: 84.6 percent). The purchase of the remaining shares in Liqui Moly GmbH and the sale of the shares in Paravan GmbH also had an impact on the cash flow statement.

Purchasing

The purchasing managers’ index for the eurozone fell steadily from its high of 60.6 points in December 2017 to 51.4 points in December 2018. Although this is still above the growth mark of 50 points, the economic situation in the eurozone is weakening. As a result, the prospects for economic development in the eurozone are no longer as euphoric as they were recently, although they are still positive.

The purchasing managers’ indices in the USA and China were very volatile in 2018 and fell significantly towards the end of the year. While the index for the USA nevertheless still reached 54.1 points in December 2018, the index for China actually fell below the 50 point mark in the second half of the year to a value of 49.4 points in December 2018.

In the first three quarters of 2018, procurement markets were characterized by generally high raw material prices, while some product areas were also characterized by supply bottlenecks and raw material shortages (e.g. for silicones and refrigerants).

Full utilization of the suppliers in some cases and the resulting long delivery times increased the pressure on the purchase prices. As a result, the Würth Group’s purchasing was confronted with drastic price demands in several areas in some cases and was forced to make price concessions in some instances in order to maintain its ability to supply the products. In the fourth quarter of 2018, positive indications regarding the situation on the procurement markets intensified. For example, trends in delivery times have recently been more favorable for us, and in recent negotiations with suppliers, we have been able to achieve positive initial results with regard to price development. We therefore expect purchase prices to remain stable across the entire product range in 2019. Nevertheless, there may well be price increases in individual sub-segments (e.g. for silicones). However, these can be offset by purchase price reductions in other product areas.

There is currently no reliable information on the outcome of the trade war between the USA and China and the effects of this trade dispute are not yet foreseeable. At the same time, the USA is negotiating a new free trade agreement with Japan. The first trade talks between the two countries were held in December 2018. The effects of such an agreement on the world economy cannot yet be predicted.

Plans call for bundling purchasing volumes for the companies within the Würth Line as part of a current project. Productivity in the area of purchasing and product management will continue to increase through the harmonization of the worldwide Würth article base and the worldwide standardization of product quality levels.

A so-called Cost Improvement Team is to be set up in 2019 to further optimize the purchasing processes within the Würth Line.

The aim of the project is to strengthen product price transparency within the Würth Line procurement function by pursuing value-analytical and cost-to-design approaches and thus to offer purchasers additional support in negotiations with suppliers.

Inventories and receivables

As a global company, the Würth Group’s inventories and receivables are key balance sheet items, which the company’s management is continually seeking to manage and optimize. Both balance sheet items allow for short-term controlling and optimization of liquidity and tied-up capital in the Group. This involves striking the right balance between making sure that our customers are satisfied on the one hand—by offering the best delivery service and adequate payment periods—and optimizing the business-related key figures on the other hand.

Sales growth of 7.1 percent in the 2018 fiscal year was accompanied by an increase in inventories and receivables. The increase in inventories was 12.8 percent to EUR 2,205 million (2017: EUR 1,956 million). This disproportionately high increase compared to sales is only attributable to acquisitions to a small extent (EUR 23.2 million). Most of this was due to stock purchases due to the tight price and supply situation on the procurement market, especially in the first three quarters of 2018. As a result, the stock turnover calculated on the basis of 12 months fell from 5.1 times at the end of 2017 to 4.8 times at the end of 2018. The positive signals on the procurement markets during the fourth quarter of 2018 no longer led to a trend reversal for this indicator. In this overall very volatile market environment, establishing a good level of inventories affords the company a certain degree of security. We aim not only to satisfy our customers but also to inspire them. This involves achieving a service degree that is close to the 100 percent mark. To achieve this, we were prepared to stock individual products in 2018, even where this runs contrary to all our business optimization efforts, in order to be able to deliver the goods to the customer one day after the order is placed at the latest. In 2018, we achieved this in 97 out of 100 cases.

Trade receivables rose by 9.7 percent to EUR 1,885 million (2017: EUR 1,719 million). For years, sophisticated controlling systems, which enable rapid responses in the event of any indications of negative developments, and an optimum interplay between sales and accounts receivable management have enabled the Würth Group to achieve a low level of receivables in relation to sales. The corresponding key figure, collection days (based on a 12-month calculation), at 53.6 days could not, however, quite keep up with the level achieved in 2017 (53.1 days). We are nevertheless satisfied with this result, considering that the Würth Group has operations in more than 80 countries worldwide each with very different payment practices. It is pleasing to note that this figure has been able to remain at a demandingly low level of 42 days in Germany for years. Traditionally, collection days in Germany are lower than at the companies outside of Germany.

We will continue to optimize accounts receivable by means of effective cooperation between sales and accounts receivable management, as well as by refining our analyses. We take a critical view of payment practices in Eastern Europe, Southern Europe, China, the Middle East and India, which are hampering growth.

The percentage of bad debts and the expenses from additions to value adjustments related to revenues fell slightly to 0.3 percent (2017: 0.5 percent).

Financing

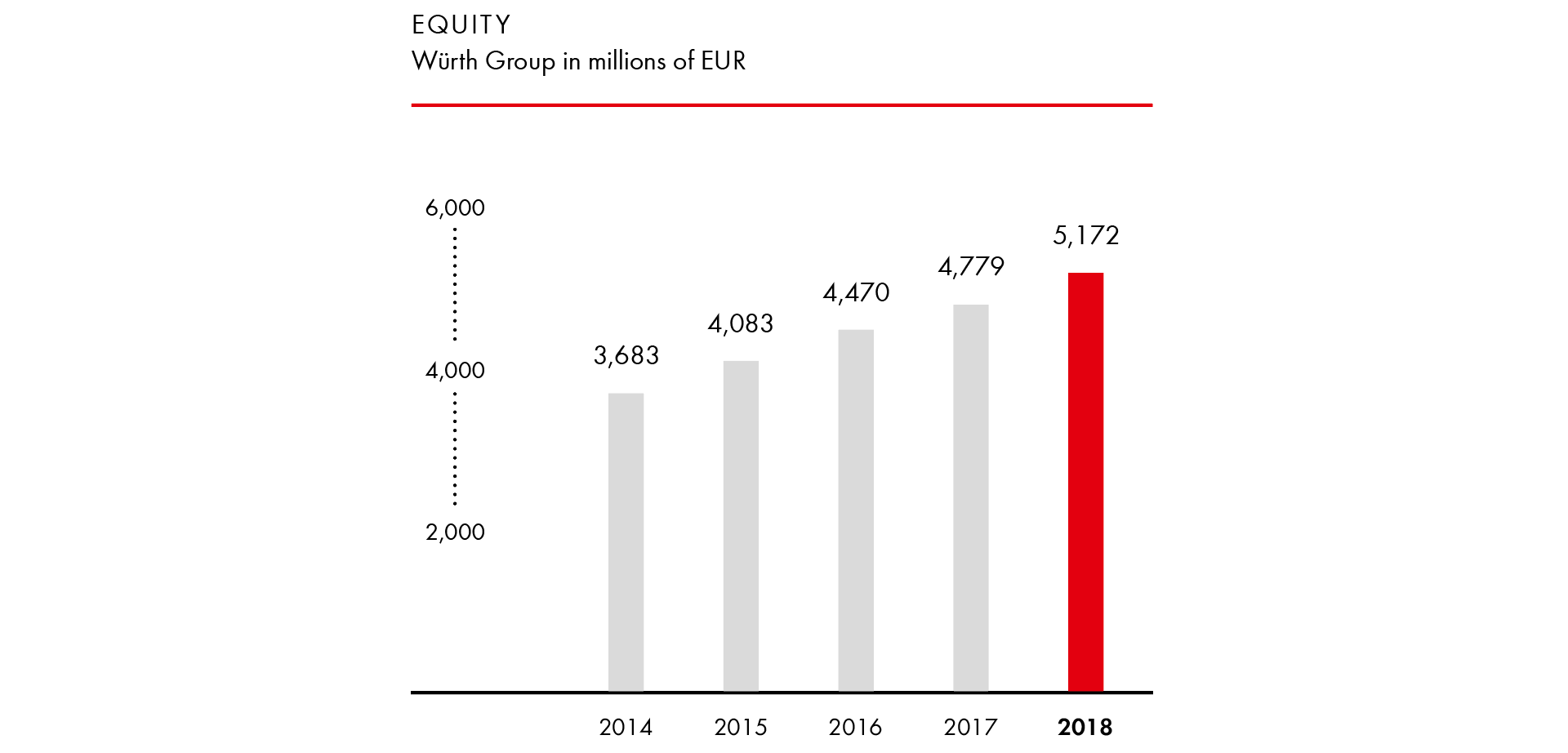

The equity of the Würth Group climbed by 8.2 percent to EUR 5,172 million. This corresponds to an increase of EUR 393 million.

This translated into another improvement in the equity ratio, which is quite high for a trading company and came to 47.1 percent at the end of the year (2017: 46.5 percent). For years, good levels of equity capitalization have been the basis for consistently high levels of financial stability and the solid financing of our group of companies, strengthening the customers’ and suppliers’ trust in the Würth Group. This is due to the typical family business approach of reinvesting a large portion of profits in the company. The high level of equity financing allows the company to be relatively independent of external capital providers.

Total assets rose by EUR 707 million to EUR 10,974 million (2017: EUR 10,267 million). This increase of 6.9 percent was largely due to the increase in property, plant and equipment and trade receivables, as well as inventories. Net debt increased from EUR 955 million in 2017 to EUR 1,207 million as a result. Financial service activities also contributed to the growth in total assets. Refinancing in the banking sector was mainly achieved through financial intermediaries and refinancing programs launched by the European Central Bank, while refinancing in the leasing segment was achieved mainly through the ABCP (Asset Backed Commercial Paper) program created especially for this purpose, as well as through non-recourse financing.

The Würth Group has undergone an annual rating process for more than 20 years now. The leading rating agency Standard & Poor’s once again confirmed the Würth Group’s “A/outlook stable” rating in 2018. This rating reflects the confidence that business and the financial KPIs will continue to develop successfully. The opportunities and potential of the Würth Group are viewed in a positive light. Our long history of good ratings not only documents the positive credit rating; at the same time, it is proof of the continuous and successful development of our corporate group and the stability of our business model.

The Würth Group took advantage of low interest rates in the capital markets to acquire long-term funds and very successfully issued a EUR 500 million eurobond on the market on 15 May 2018 through its financial company Würth Finance International B.V. The bond has a term of seven years and an interest coupon of 1.00 percent p. a. The issue strengthens the long-term financing and liquidity base of the Würth Group as the basis for future Group growth. The average maturity period of outstanding financial liabilities of the Würth Group extended itself considerably as a result. With the redemption of the EUR 500 million bond, which bears interest at 3.75 percent and matured on 25 May 2018, the average interest rate for the Würth Group’s interest-bearing debt was significantly reduced. At the end of the 2018 fiscal year, the Würth Group thus had three bonds issued on the capital market and one US private placement. All covenants in this context have been observed. In 2020, 2022 and 2025, bonds worth EUR 500 million each will reach maturity, while the private placement of USD 200 million is set to reach maturity in 2021. Maturities are therefore well distributed. For further details of the maturity profile and interest structure, please refer to the consolidated financial statements: H. “Notes on the consolidated statement of financial position”, [25] “Financial liabilities”.

As of 31 December 2018, the Würth Group had liquid funds of EUR 493 million (2017: EUR 671 million). In addition, the Group has a fixed credit line of EUR 400 million, which remains undrawn to date, provided by a syndicate of banks until July 2023. Liquidity reserves are therefore sufficient. The Würth Group has a “Euro Medium Term Notes” program in place as a basis for long-term financing. This program offers a high degree of flexibility in the issuance of bonds.